Choosing a bank for your business

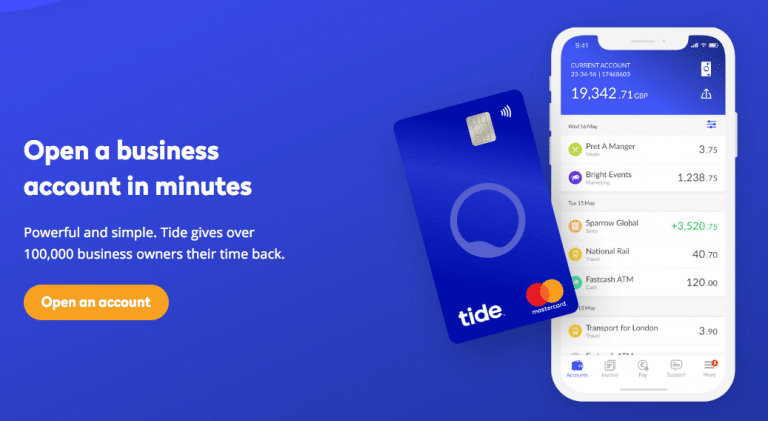

There are more and more online and mobile banks for professionals and companies. The term neo-bank is now part of our vocabulary to describe its new players who wish to disrupt traditional banks with unbeatable rates and an extraordinary user experience. It now only takes a few minutes to open a business account.

[lmse-sc target=”cta-simple” service=”bank”]

Although opening a bank account for a small business is not mandatory, a business account is a necessity for its financial success. Not only is it easy to manage the business financial accounts, but your business also gains a professional image when all financial transactions are done through a bank account. There is a wide range of high street banks and neobanks providing numerous account options for small businesses.

Choosing the bank that best suits your business needs can, therefore, be challenging.

This article outlines some of the best small business checking accounts and the criteria you should employ in choosing the right banking service provider.

Whether you are starting a small business, company, or you are already well established. Opening a business checking account is a priority.

Finding the best business checking account is another crucial responsibility. With a business checking account, you can easily separate your business money from your personal finances. You can pay your suppliers, employees, and partners without having to worry about extravagant expenditures.

You get to enjoy free monthly transactions and cash deposits. It's more important since it increases your chances of getting a business loan. You don’t have to spend hours sorting receipts and bank statements or trying to sort your incomes profits and taxable.

Is your limited company among the 672, 890 companies registered between 2018 and 2019 in the UK? Do you have a business bank account yet? Well, saving money in your save box at home or office is not safe, especially when you're running a limited company. First, that's a lot of money to keep in your safe. Secondly, when an emergency catches you, you're likely to use the business money, thus, loss.

According to statistics almost 60% of the current UK business population consist of sole traders, who are spearheading the UK business growth. During the past year more than 200,000 new sole traders started doing business on their own, this clearly shows that many people who were previously employed as workers decided to venture into business on their own as a small business or a sole trader. To ensure their future success it is of vital importance that they start their business off on the right footing and that includes

the choice of a bank account. In this article, we will look at the type of bank account that any small business owner or self-employed person is obliged to open.

Opening a bank account for a partnerships company is a crucial step towards achieving financial success as a business. Separating your personal accounts from those of the partnership company not only helps you in organising the accounting records of the company but also enables you to cut on overspending. No law requires a partnerships or sole proprietorship business to have a business bank account. However, there are still more reasons why you need to have a joint bank account with your business partner.

Here is a guide on everything you need to know about business bank accounts, including some of the best bank accounts for your business.

Holvi was founded by entrepreneurs who boast of an exceptional understanding of the unique challenges of building a small business enterprise. With FinTech – the latest innovation in financial technology at hand, Holvi has managed to build an all-inclusive banking service that restructures most of the time-consuming and complicated financial processes. With Holvi, entrepreneurs can get back their time.

Once you have started a business, you need to ensure that you get a reliable and supportive bank to hold your money. Regardless of the complexity of your operation, finding the right bank for your small business is necessary. This decision does not require you to consider only the current needs of your business, but its future wellbeing as well. The nature of the bank you select can impact your business either positively or negatively. If you are looking to be on the loan market in the near future, then you need to learn a few tricks that you could use to get the right bank for your business.

Before we delve into the things to consider while finding the best bank for your business, let’s take a brief look at the different types of banks available.

Historically, the banking industry has been a monopoly, with the big players holding power. But a new class of digital-only institutions is disrupting the industry. Until recently, the banking sector has been a highly impenetrable market. However, as confidence in traditional banking systems is constantly decreasing, "neobanks" are moving up.

Neobanks are the new type of digital-only financial institutions, emerging to leverage the public's resentment towards traditional banking incumbents. A survey performed by YouGov's reports that 10 years after the 2008 financial crisis, people's trust and confidence in banks is at an all-time low. According to the survey, two-thirds of adults in the UK believe that banks don't have their customers interests in mind. Also, 75% of British adults consider that banks should have incurred more severe penalties for what happened during the 2007-2008 financial crisis. "Neobanking" has become a popular term in the media, but what exactly is it? Here's a brief about neobanks explaining what they are, how they work, their advantages, and how your business can enjoy streamlined banking solutions.