Monzo neobank is an online bank that serves individual and business customers in the U.K. The bank is a pioneer in the nascent challenger banking segment that relies on technology to provide financial services.It was founded in 2017 and initially offered services through a prepaid debit card before transitioning into a fully-fledged online bank.

The bank has experienced tremendous growth over the past year, reaching one million customers in October 2018 and gets over 55,000 new customers every week. Through its several crowdfunding initiatives, the company has managed to accrue substantial equity such that it is now valued at over $2 billion. It has over 2.7 million customers and accounted for 15% of all new accounts opened in the past year.

Benefits of Monzo accounts

Monzo app works on both Android and iOS phones. All payments trigger instant notifications on the user’s phone with the option for the customer to view their transaction history.

Employed customers can access their salaries earlier than they would get with traditional banks at no extra cost. Monzo releases customer salaries a day before the due date provided that they are paid through a Banker’s Automated Clearing Service (Bacs). All one needs is to press the Add Money icon on their app to add a new source of payments to the list of debtors. The app will send a notification once the money is ready, and customers can proceed to withdraw or spend.

Monzo is multiple times more effective at preventing fraud than most online banking platforms provided by traditional banks. It is a full-service digital bank whose infrastructure is designed for the mobile banking environment.

Its business model allows it to be agile and act as a cost leader in the financial services sector as it not constrained by the structures used by traditional banks.Customers can earn up to 1.71% interest on their savings in fixed accounts. With the fixed saving account options, you can watch your pot grow until it is enough to buy a home or cover your dream holiday.

All the savings are protected under the Financial Services Compensation Scheme (FSCS).The Monzo app helps customers with their budgeting by setting budgets for different expenses and notifying them when they overspend.

The Monzo MasterCard is universally acceptable and can be used while travelling abroad. The app does not charge customers for overseas expenditure or set inflated exchange rates to extract exorbitant fees from its customers.

Customers can access overdrafts of up to $1,000 and loans up to $15,000. The loan application process is very simple minimal paperwork. The bank also allows customers to pay back loans early without incurring penalties.

Partnerships

Modern bank customers operate in a globalised world, and it is important to have a financial partner that facilitates seamless fund transfer on different platforms and across jurisdictions.

- Monzo collaborates with Transferwise to facilitate international money transfer for its customers.

- Monzo works with Investec to provide an interest income for customer savings.

- Customers can also make cash deposits into their Monzo accounts using PayPoint. Users pay a $1 fee for every deposit they make.

- Monzo partners with Flux to provide customers with itemised receipts and run its loyalty program.

- The company has struck a partnership with Sutton Bank that will enable it to venture into the U.S. market. It intends to facilitate customer transactions through debit cards though it will later introduce the full spectrum of services to U.S. market.

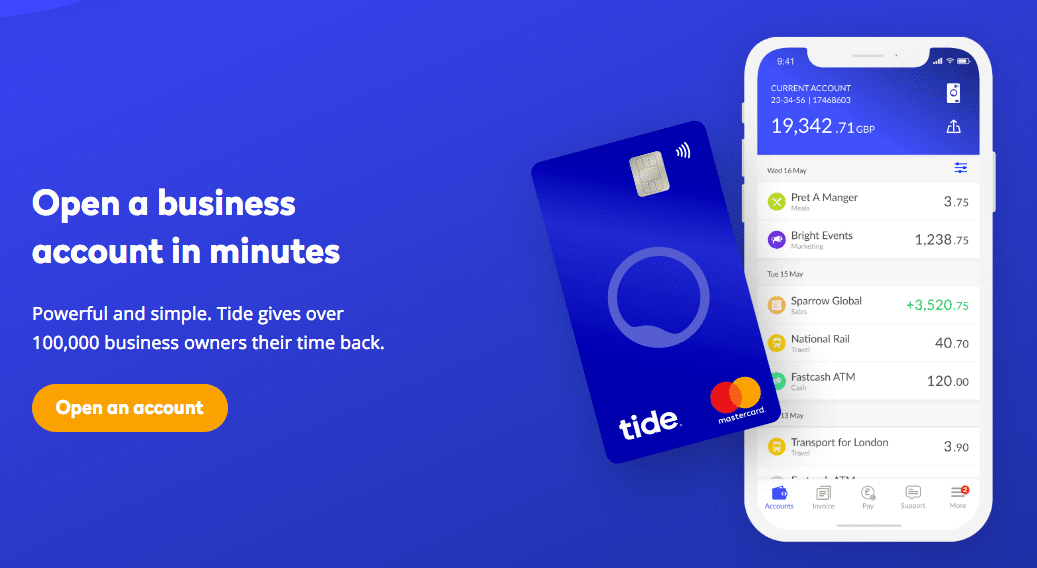

Business accounts

Monzo offers sole proprietor, joint,and limited company accounts to its business customers. Sole proprietors can use their personal accounts to run a venture while business accounts come with several features that facilitate routine operations. Business owners and managers access accountancy tools such as FreeAgent and Link Xero that assist in collating transactions and preparing financial reports. Owners can also allow employees, such as directors and accountants to access their bank records. The bank offers 24/7 customer support to its business customers. Users can also set aside funds in pots to cover overhead costs such as power and insurance bills. Customers can apply for contactless MasterCards that can be used by different employees to access the account. The bank allows businesses to make direct debits and instant bank transfers.

How to Join Monzo neobank

To open a Monzo account, you need:

- an Android or iOS Smartphone

- a national ID

- be aged 16 or above

- be a resident of the U.K.

- an U.K. address

- Those who do not possess a valid ID can use:

- a passport

- driving license including a provisional

- firearm certificate

- electoral identifier for Northern Ireland

- biometric residency permit

Once you are armed with the documents, you can download the Monzo app either directly from the Apple App Store or the company Play Store. The app will request you to provide details such as home and email address, phone number, and the services you intend to use.

You will conduct identity verification by uploading a selfie video to confirm that you own the documents. The aim is to ensure that the image in the video matches that on the ID. Next, you will indicate where you want your card to be sent, such as home address or office. You will then create a PIN number to use with the card. Once the account is verified, the debit card will be posted and should arrive in less than a week.

You can add the Monzo card to Apple or Google Pay so that you can proceed with transactions even as you wait for the MasterCard. When the card finally arrives, you will need to activate it by either taking a photo with the app or manually entering the card number. After completing this task, you become a member of the Monzo community free to use the app for all your financial services.

Wrapping it up

Monzo offers a sleek, user-friendly, and safe service that is suited to the modern banker. It is a hassle free way of accessing financial services for both individuals and businesses. You are welcome to join the growing community of online bankers and write your own page of fintech history.